Award revenue can be used for a variety of business functions, but you will confront Competitors for this “totally free” capital. And the appliance system ordinarily can demand a substantial expense of time.

Since we don’t exist to produce financial gain, we use the money from a repayment to help other business house owners

Unsecured loans are granted to corporations with sound credit history scores and may supply lower interest prices than secured loans.

In contrast, when family and friends put money into your business, there isn't any obligation to repay the funds they offer you. In its place, The cash been given is in exchange for partial possession of your business and, probably, a share in foreseeable future revenue.

You may also want to take into consideration your existing romantic relationship with the person. For example, a relative who you’ve previously borrowed dollars from and repaid is probably going to generally be a lot more receptive than the usual loved one with whom you have a tense marriage or ongoing dispute.

Homeowners insurance coverage guideHome coverage ratesHome coverage quotesBest household coverage companiesHome coverage insurance policies and coverageHome coverage calculatorHome coverage reviews

OnDeck was Started in 2006 and it has given that been a number one provider during the business lending Room, presenting both equally term loans and features of credit. Up to now, the business has extended $fourteen billion in funding to small businesses.

Business prepare. This could include a worth proposition, financial statements and projections, information of any current debts, and a transparent outline of how the SBA loan resources is going to be utilised.

Though the repayment time period depends upon the borrower and lender, bank loans can provide limited-term or long-term financing. Financial institution loans generally don’t have usage stipulations but feature desire costs and repayment schedules.

Corporation listings on this webpage Usually do not indicate endorsement. We do not function all suppliers available. Besides as expressly established forth in our Conditions of Use, all representations and warranties about the knowledge offered on this site are disclaimed. The information, which include pricing, which seems on This website is subject to change at any time

Rigorous credit score specifications. Standard lenders might need a specified credit rating score or potent credit history historical past for acceptance.

To qualify for the most effective business loans, lenders will here assessment facts about you and your business, which include:

Much more than just loans for small business –– We also offer educational means, coaching, and use of aid networks

In addition, it could be challenging to qualify for specified loans. Should you or your business don’t have good credit or your business operates within a significant-threat field, lenders will most likely only supply unfavorable loans with significant desire costs.

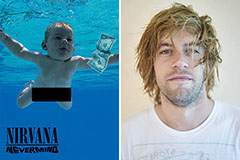

Spencer Elden Then & Now!

Spencer Elden Then & Now! Michael Oliver Then & Now!

Michael Oliver Then & Now! Tahj Mowry Then & Now!

Tahj Mowry Then & Now! Batista Then & Now!

Batista Then & Now! Nadia Bjorlin Then & Now!

Nadia Bjorlin Then & Now!